Sula Vineyards IPO: How 'high' are the prospects?

A quick read on wine making business in India with focus on Sula Vineyard's & its financials, comparison with listed alco-beverage Cos. and inherent risks to this Indian wine biggie

Wine has always been associated with affluence, celebration and even holds its place as sacred offering in some religions. Indian public market is all set to welcome the IPO of the largest domestic wine manufacturer of the country - Sula Vineyards.

Business of Wine making in India

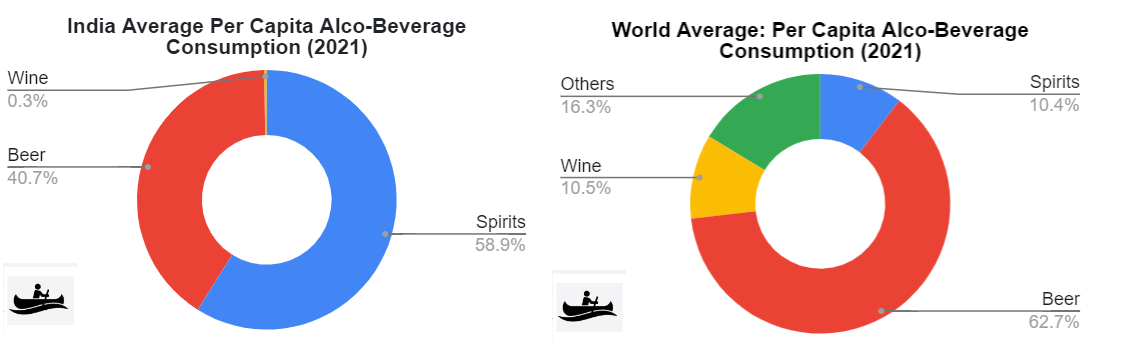

Techopak Analysis (widely quoted in DRHP) pegs Indian alcohol industry more than billions cases (1 case = 9L) per annum in FY2020 or INR 2.5 Lakh Crores, making it one of the biggest markets in the world. Per capita alcohol consumption in India moved from 0.9L in 2000, to 1.6L in 2010 & 2.7L in 2019. Translating to CAGR of 6% between 2000-2019, slower than that between 2000-2010 where it grew 12% CAGR.

Contrary to popular belief, data seems to indicate consumption of alcohol has gotten slower in India.

Alcoholic Beverages are divided into 3 major product categories - Spirits, Beer & Wine. India has a very unique consumption distribution where 90% of the alcohol is consumed in the form of spirit. Specifically, wine makes it to less than 1% . Per Capita wine consumption in India stands at 0.04 Liters with the global average being 5.45 L.

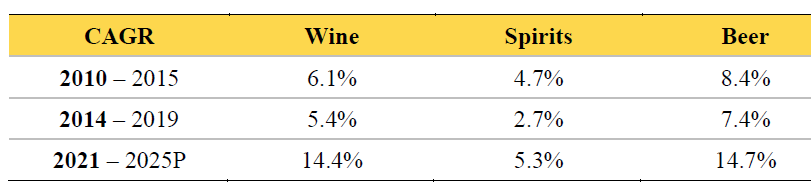

The extent of runway available for wine consumption in India on its way to catch the global average makes wine business an interesting investing proposition even though alcohol consumption might have hit some sort of ceiling.

While consumption of each of these product categories has slowed down in 2010-2019 phase, wine comparatively has shown greatest resilience and spirits the least.

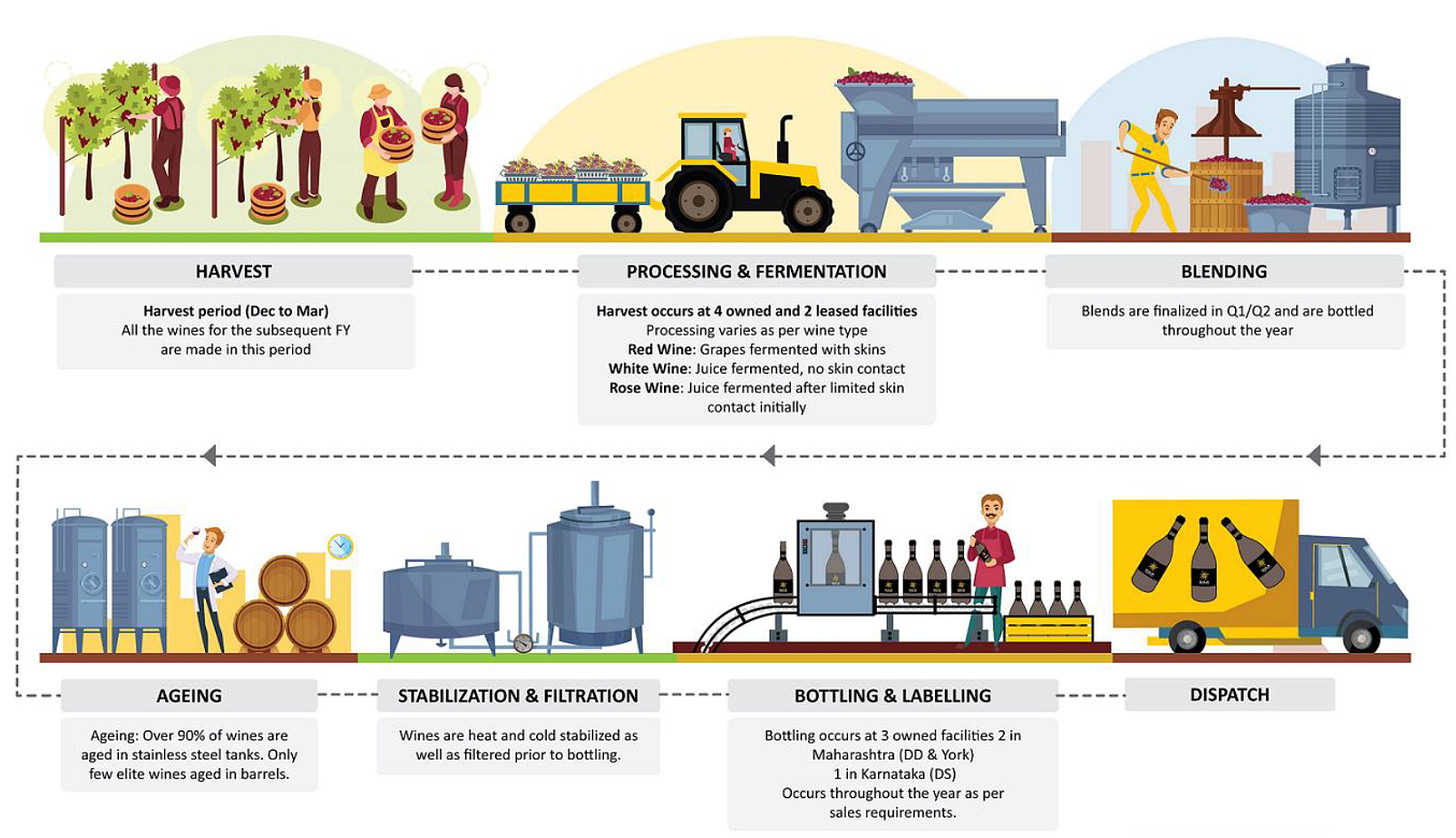

The business of wine revolves around the peculiarity of the production process. The grape harvest season in India lasts from December until March with major wine producing states being Maharashtra & Karnataka. The entire supply for the upcoming financial year is made in this harvest season.

On the consumption side too, bulk of the demand comes in towards the onset of festive season from October rising till December before flattening out till the end of fiscal year. These factors makes wine business capex & working capital intensive.

While loosely wines are said to be made from grapes but its specifically wine grapes that are used as raw material. Normal grapes (which are also called Table grapes) needs a small tweak during production to become wine grapes. India boasts of 140,000 hectares of grape farms, 12th in the world, however only 2% of those are cultivating grape wines.

With wine grapes being more profitable to farmers with higher per quintal returns, farmers are happy to harvest wine grapes provided returns are guaranteed. But there is a lot of hard work required by the farmers who needs to spend many years waiting for the first harvest. Post harvest also it can take up to 2 years to manufacture authentic wine. This is where long term contracts lasting 10-12 years becomes a critical piece. Wineries get into such contracts with the farmers making it tough for new players to jump in the business overnight. Launching new wine brands & products are time consuming process.

Another unique feature of Indian wines business is top 3 players contribute 80% of the market in value terms. Sula Vineyards commands market leadership with 52% in FY20 (by value) followed by Fratelli Wines & Grover Vineyards limited.

Closer look at Sula Vineyards’ business & financials

Revenue is primarily a function of the volume of wines produced and sold by wineries.

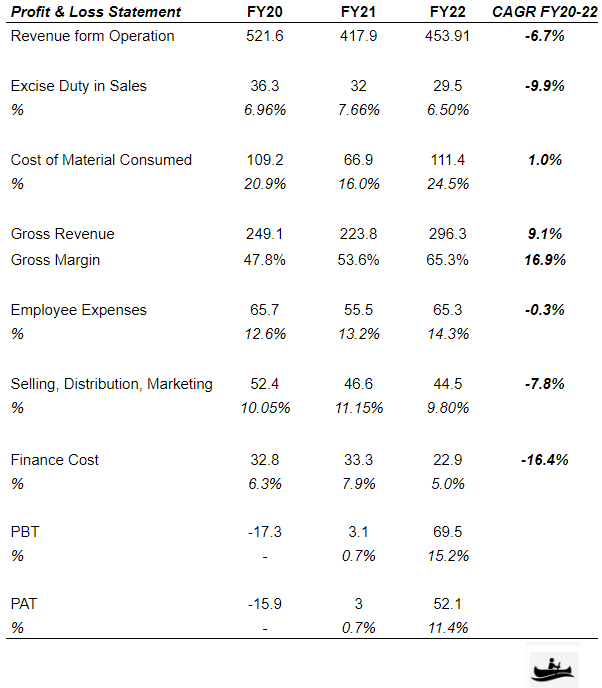

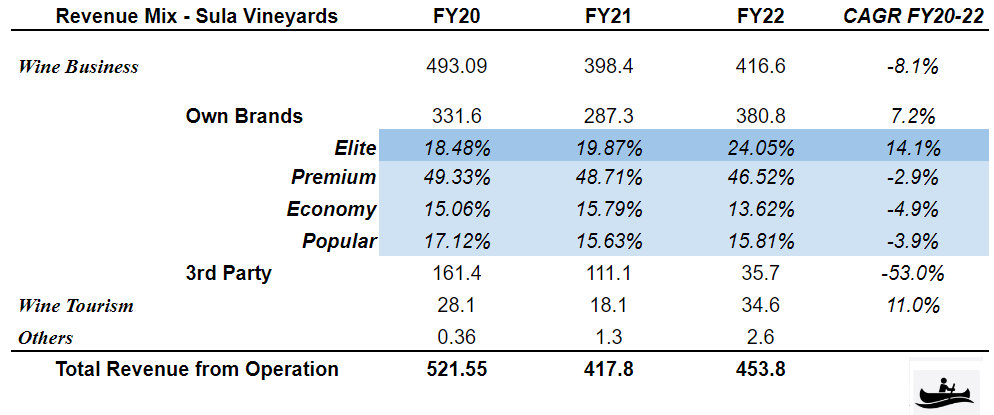

Sales from operation has not been able to live up to the whole story of growth of wines and in fact has shown slowdown in last 3 year period. While COVID is partly to be blamed, discontinuation of Beer business by its subsidiary PADPL (which cease to be a part of Sula from FY21) played the primary role. Letting go of an hot segment doesn’t bode well until its observed that it forms part of the larger strategy to move away from 3rd party products and focus on own brands, thereby improving margins.

Alcohol consumers stay loyal to their brand and once a while up trade (go for pricier brands/labels). The YoY improvement in Gross/Net margins is due to conscious & constant ‘Premiumization’ - focused effort to produce & sell high margin products and slow down the low margins ones.

Of the 4 segments, ‘Elite’ - the most premium brand, was the only segment which grew (at considerable rate). In FY21 (same year of moving out of Beer, IMFL business by selling its subsidiary) it acquired York Winery, which not surprisingly has the largest labels in the Elite segment.

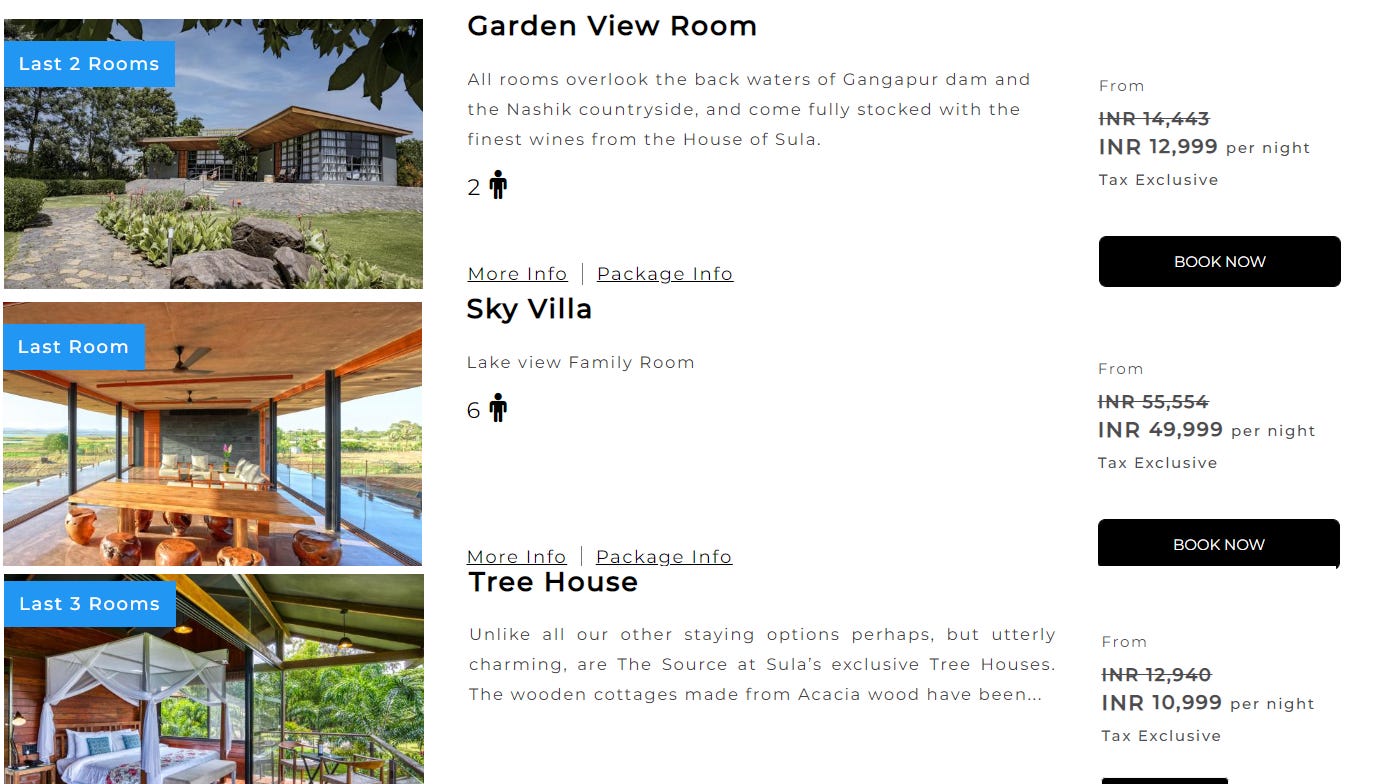

Wine Tourism - a concept Sula has pioneered in India, is another engine which is working to make wine consumption experiential while introducing new consumers to wine. The revenue contribution is still modest ~8% but its showing healthy growth. This has opened up a D2C business (which is otherwise not possible for any other alco-beverage product). Again boosting the margins upwards!

Apart from wine tourism, Sula Fest is another annual event (since 2008) which attempts to increase wine consumers in India. In 2020 it witnessed the footfall of over 10,000 people although like the year 2021, 2022 will also not see this music festival (centered around gourmet food and of course wine!) due to COVID. It is also using social media (5th highest followers in Instagram among vineyards globally) for demand generation.

It has done a fairly good job at reducing most of the cost heads. Be it by manufacturing its own bottles, introducing stainless steel wine maker or screw cap in place of cork to prevent leakage, Sula’s innovation has helped it cost control across value chain.

Excise Duty remains an unpredictable piece. State governments has time & again treated Excise a low hanging fruit for income to their state treasuries. While the trend over the past couple of years indicate the rates are getting largely stagnant or lower. States (like Maharashtra, Karnataka, UP etc.) have also begun to recognize wine production as a horticulture & food processing industry, as a result wines are far more likely to receive promotion by these governments compared to other alco-beverages.

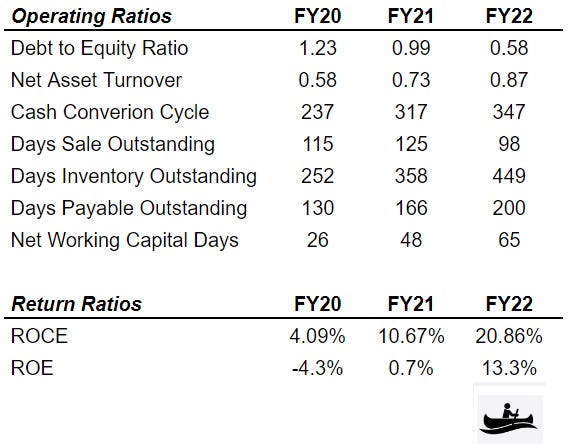

Owing to raw material production cycle where the harvest season lasts only between December to March which caters to demand of the entire following year bulk of which is during the festive season between October & January, the business is working capital & inventory heavy. This is evident with higher levels of debt (compared to other alco-beverage players) on Sula’s balance sheet. While its commendable that D/E ratio has been consistently been coming off, thereby taking down the finance costs with it. But, that has brought the cash to a very low levels, just around ~10 Cr.

The silver lining - its inventories doesn’t lose value (have you ever seen an expiry on bottle of wine?) with the passage of time, in fact its quite the contrary (ageing like fine wine, they say!)

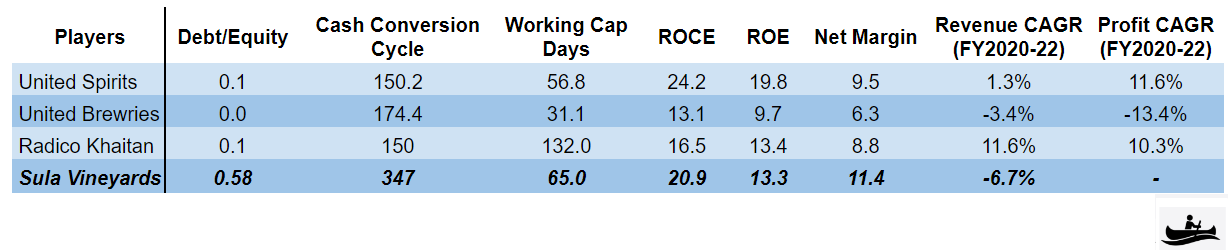

Comparison with listed competitors

There are no listed wine players in India. So I placed top-3 listed alco-beverage companies alongside our protagonist to see how it fared.

The high inventory, high working capital requirement and higher debt levels owing to that is clearly showing up on most metrics. However, the premiumization game is quite strong for Sula, which stands out in Net Margins. Due to FY20 being a loss year and fall in the revenue due to the divestment of the beer & IMFL subsidiary the CAGR can’t be compared.

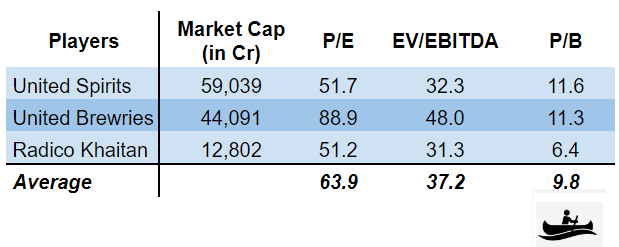

Valuations

At the time of this writing, Sula has yet to come out with its IPO pricing. But, its worth looking at where the listed players stack against each other on valuation front.

Risks & Challenges for Sula

Indians - High on ‘Spirits’

For Indian consumers the idea of deriving pleasure from an alcoholic drink is primarily about getting a high and even for those who see it as an experience, wine has not caught as an preferred drink. Wine loyalists are far & few and its still a celebration drink meant for special occasions only.

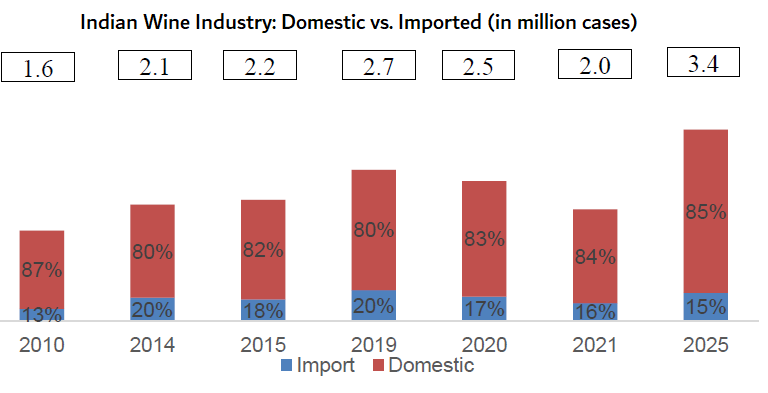

Wine import

Indian consumer looks up to native wine producing countries in owning the beverage as an originator (French Wine & just wine has starkly different ring). Thankfully for domestic players like Sula, imported alcoholic beverages attracts 150% of value of wine as import duty keeping imported wines in check. But, it can’t always be relied on. Like in April, 2022 India & Australia entered into a Trade Agreement where phases reduction in import duty over the period of 10 years on certain imported Australian wines.

Revenue Concentration

The divestment of PADPL (Progressive Alcobev Distributors Private Ltd.) in FY21 by Sula led to an material drop in the revenue. Currently Revenue from top-5 customers (Wholesale/Distributors/State corporation) have been on an increasing trend. In FY22, FY21 & FY20 the contribution from them have been 37.25%, 35.76 % & 32.31% of the total revenue, increasing concentration risk.

Final thoughts

The bang for the buck in wine business lies with rapid adoption of wine as a drink of choice in alco-beverage category. Its a demand problem. If you feel that’s inevitable you should consider this IPO, because as a market leader Sula will benefit most out of it.

Being capital intensive, long term contract heavy business provides natural barrier to entry but also hurts the cash flows. Cash raised through IPO could have certainly helped retire some long term debt, but its disheartening to know this issue is completely an offer for sale (OFS). Pricing of the issue will be critical but looking at listed players’ valuation, I think this issue will be valued at the higher end citing no listed wine players (scarcity premium) and long growth runway available. Will be happy to be proved wrong!

Hope you found this article thought provoking & interesting. If you missed reading by KRSNAA Diagnostics: Can the OG of price disruption rise above the rest? by Dalal Street Rafting check it out below.

Disclaimer: Views presented in this article is personal opinion of author and doesn’t not represent any firm’s view that he is currently associated or might have been associated in the past. No part of it should not be considered as a recommendation to buy or sell any stocks etc. This is an educational article at best. Although care has been taken for correctness of the data, author does not take any responsibility for any errors or omissions. Readers should consult their financial advisers before taking investment decision.

Interesting, insightful.